Business

Standard Chartered CEO Defends ESG Investing Amid U.S. Backlash

- Standard Chartered chief executive Bill Winters defends environmentally conscious investing, dismissing U.S. backlash against ESG.

- Winters emphasizes the importance of sustainable practices for both the planet and business profitability.

- Despite political tensions, Winters highlights ongoing engagement with net-zero objectives and business growth.

Standard Chartered CEO, Bill Winters, asserts that environmentally conscious investing remains beneficial for businesses, despite the political backlash against ESG (environmental, social, and governance) initiatives in the United States.

In an interview with CNBC’s “Squawk Box Europe,” Winters addressed concerns surrounding the perception of ESG as “woke capitalism,” emphasizing the importance of prioritizing sustainable practices. He stated, “I mean, I do want to wake up one day and have a planet so if that makes me woke, shoot me.”

Acknowledging the politically charged environment in the U.S., Winters pointed out the irony of Texas, a leading state in renewable power, opposing pension fund managers with ESG agendas. However, he remains committed to sustainable efforts, citing Standard Chartered’s dual-track objectives of achieving net-zero carbon emissions by 2025 and 2050 for its own firm and financed emissions, respectively.

Winters emphasized the alignment of sustainable initiatives with business profitability, noting the continued engagement of clients in pursuing net-zero goals. He highlighted the growth of Standard Chartered’s business supporting sustainable practices, indicating a positive outlook for both environmental impact and financial returns.

Despite challenges and political tensions, Winters reaffirmed the company’s dedication to sustainability, emphasizing that it is “not philanthropy” but a commitment to “do the right thing for the planet” while ensuring business success.

Business

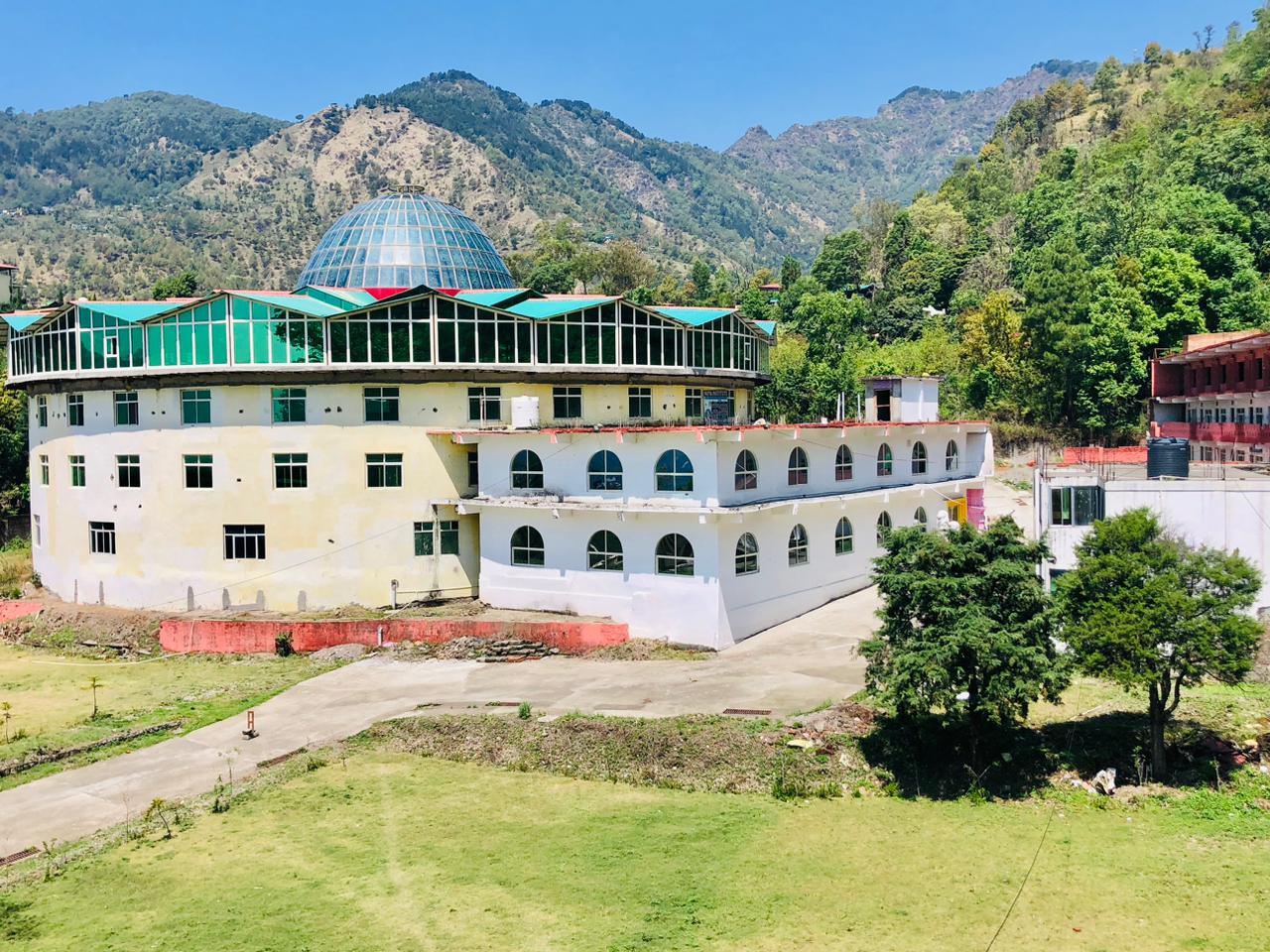

MPB College: Empowering Tomorrow’s Healthcare Leaders

In the picturesque landscapes of Uttarakhand, near the charming town of Nainital, lies MPB College, an esteemed institution dedicated to shaping the future leaders of healthcare. With a commitment to academic excellence, compassionate care, and community engagement, MPB College stands as a beacon of inspiration in the realm of medical education.

Vision and Mission: Pioneering a Future of Healthcare

At MPB College, our vision transcends conventional boundaries. We aspire to redefine the landscape of medical education, fostering a community where academic rigor seamlessly intertwines with compassionate patient care. Our mission is clear: to empower students with the knowledge, skills, and ethical principles needed to excel as proficient, empathetic, and lifelong learners in medicine. Through research excellence, patient-centered care, community engagement, and ethical conduct, we endeavor to positively impact the health and welfare of individuals and communities alike.

Academic Excellence: Shaping Tomorrow’s Healthcare Professionals

Our commitment to academic excellence is unwavering. We offer a diverse range of programs, including Bachelor of Science in Nursing (BSc Nursing), Bachelor of Physiotherapy (BPT), General Nursing Midwifery (GNM), and Bachelor of Medical Laboratory Technology (BMLT), among others. With a rigorous curriculum, state-of-the-art facilities, and experienced faculty, we ensure that students acquire the essential knowledge, clinical skills, and ethical values required for successful medical practice.

Research and Innovation: Advancing Medical Science

At MPB College, we foster a culture of research and innovation. Our faculty and students are encouraged to engage in groundbreaking research that tackles pressing healthcare issues and propels medical science forward. Through scientific inquiry, evidence-based practice, and technological advancements, we aim to contribute significantly to the understanding, prevention, and treatment of diseases, ultimately leading to improved patient outcomes and advancements in medical science.

Patient-Centered Care: Compassion at the Core

Central to our mission is delivering compassionate, culturally attuned, and evidence-based patient care. We imbue our students with a profound sense of empathy, cultural sensitivity, and a holistic approach to patient well-being. Our goal is to produce healthcare professionals who prioritize patients’ dignity, honor their autonomy, and provide tailored care that fosters healing and holistic well-being.

Community Engagement and Public Health: Making a Difference

We recognize the vital role of healthcare professionals in promoting public health. That’s why we actively engage with local communities, collaborating with healthcare organizations, public health agencies, and community leaders to address health disparities, implement health promotion initiatives, and advocate for policies that enhance healthcare accessibility and equity.

Ethical and Professional Conduct: Upholding Integrity

Ethical values and professionalism are at the core of our educational approach. We strive to cultivate a strong sense of integrity, responsibility, and ethical decision-making in our students. We aim to produce healthcare professionals who uphold the highest standards of professionalism, ethics, and accountability in their practice, earning the trust and respect of their patients and peers alike.

A Vibrant Community: Embracing Opportunities Beyond the Classroom

Beyond academics, MPB College offers a vibrant extracurricular landscape. From sports competitions to artistic pursuits, and academic clubs to community service initiatives, students have countless avenues to explore passions, hone talents, and forge lasting connections. Our inclusive and welcoming environment fosters personal growth, leadership development, and a sense of belonging among all members of the MPB community.

Contact Us: Your Journey Begins Here

Embark on your journey to excellence in medical education with MPB College. Whether you have questions about admissions, scholarships, or programs, our friendly and dedicated team is here to assist you every step of the way. Connect with us via phone, or email, or visit our website to learn more about how MPB College can help you achieve your academic and career aspirations.

Conclusion: Join the MPB Community

In the heart of Uttarakhand, MPB College stands as a testament to the transformative power of education. With a vision to redefine medical education and a mission to empower future healthcare leaders, we invite you to join our community. Together, let’s pave the way to a brighter, healthier future for all.

Apply Now to Begin Your Educational Journey at MPB College

Business

OVER THE REALITY is the Largest Depin Project and unveils the launch of the New feature called Map2earn

Over the Reality, a pioneering force in spatial computing has announced its latest milestone in the realm of augmented reality (AR). The company has revealed the integration of Apple Vision Pro, marking a significant advancement in spatial computing technology. This strategic collaboration positions Over the Reality as a leader in delivering cutting-edge AR experiences to users worldwide.

The integration of Apple Vision Pro into Over the Reality’s platform represents a monumental leap forward in the field of spatial computing. By harnessing the capabilities of Vision Pro, Over the Reality aims to provide users with state-of-the-art AR experiences, setting new standards for innovation and user engagement in the industry.

In addition to the integration of Vision Pro, Over the Reality has introduced a groundbreaking rewarding system called Map2Earn. This innovative feature allows users to actively participate in mapping the world while potentially earning $OVR tokens. By engaging with Map2Earn, users not only contribute to the creation of a comprehensive 3D immersive map of the Earth but also have the opportunity to be rewarded for their efforts.

The launch of Map2Earn underscores Over the Reality’s commitment to empowering its users and fostering community participation in shaping the global digital landscape. Through this rewarding system, Over the Reality aims to incentivize users to explore and map various locations, ultimately contributing to the expansion and enrichment of its spatial computing platform.

Over the Reality’s dedication to excellence is further demonstrated by its continuous efforts to revolutionize AR experiences and redefine the boundaries of spatial computing. With the integration of Apple Vision Pro and the introduction of the Map2Earn rewarding system, Over the Reality solidifies its position as a trailblazer in the field, offering users unparalleled opportunities for immersive engagement and digital exploration.

As Over the Reality continues to lead the charge in spatial computing innovation, the company remains committed to pushing the boundaries of what is possible in the world of augmented reality. With Vision Pro integration and the Map2Earn rewarding system, Over the Reality invites users to embark on a journey of discovery, creativity, and community participation in shaping the future of spatial computing.

For more information about Over the Reality and its latest developments, visit their website and join the global movement towards reimagining reality through immersive digital experiences.

Business

Europe’s GRANOLAS: Powering Stock Markets to New Highs Amid Magnificent Seven Comparisons

In a remarkable feat, just 11 stocks have been the driving force behind half of the gains propelling Europe’s pan-European Stoxx 600 stock index to record highs. Termed the “GRANOLAS” by Goldman Sachs in 2020, these stocks represent a group of “internationally exposed quality growth compounders” with substantial market caps, akin to the Magnificent Seven U.S. tech giants.

Comprising GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, and Sanofi, the GRANOLAS collectively account for approximately a quarter of the Stoxx 600’s total market cap. Goldman Sachs analysts underscore their solid earnings growth, high margins, and robust balance sheets as key drivers of this group’s momentum.

Despite trading at high price-to-earnings ratios, typical of growth companies, the GRANOLAS offer significant value compared to their U.S. counterparts. They exhibit lower volatility, contributing to an enhanced Sharpe ratio and making them an attractive investment proposition.

Goldman Sachs forecasts continued strong growth for the GRANOLAS, with a projected 7% compound annual growth rate in revenue through 2025, outpacing the wider market. Moreover, these stocks offer dividend yields in the 2-2.5% range, further enhancing their appeal to investors.

While concerns about concentration risk loom, analysts point out the diversity of sectors represented within the GRANOLAS group, potentially mitigating such risks. However, caution is warranted, as prolonged market complacency could leave equities vulnerable to negative surprises, underscoring the need for prudent risk management strategies.

As Europe’s GRANOLAS continue to dominate stock market gains, investors are closely monitoring their performance amid comparisons to their U.S. tech counterparts and the potential implications for broader market dynamics.

-

Politics3 months ago

Politics3 months agoFormer Swiss Air Force Officer Pascal Najadi announces the imminent surfacing of the covert US led Defense War Operation #STORM in Public Address at the Tomb of Napoleon Bonaparte in Paris in January 2024.

-

Sports3 months ago

Sports3 months agoFormer MLB Pitcher Arrested in Connection with 2021 Murder of Father-in-law, Authorities Report

-

Entrepreneurship3 months ago

Entrepreneurship3 months agoLakshay Jain: Entrepreneur Extraordinaire Expands Horizons with Mascan, a Digital Media Holding Powerhouse

-

Technology3 months ago

Technology3 months agoAnalysis: What Lies Ahead for Paytm’s Banking Arm Following Regulatory Intervention by India’s Central Bank?

-

Technology3 months ago

Technology3 months agoeSec Forte Technologies Receives Prestigious Award for Make in India Forensic Hardware Development at Future Crime Summit 2024

-

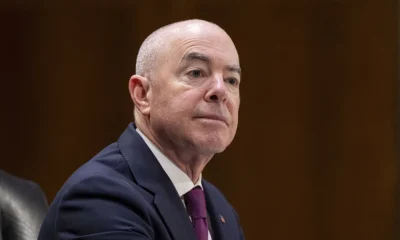

Politics3 months ago

Politics3 months agoHouse Republicans Unveil Impeachment Articles in Bid to Remove Homeland Security’s Mayorkas Over Border Issues

-

Sports3 months ago

Sports3 months ago2024 NBA Draft Expands to Two-Day Spectacle: Second Round Set for Day After First Round

-

Sports3 months ago

Sports3 months agoGreen Bay Packers Make Surprise Move, Tap Boston College’s Jeff Hafley as New Defensive Coordinator