Technology

Tecno Spark 20: Key Specifications and Pricing Teased Ahead of India Launch

Tecno is gearing up to unveil the Tecno Spark 20 in India, and the organization is already generating exhilaration by using teasing key specs and pricing information on an extraordinary microsite on Amazon. This upcoming cellphone could be had in four vibrant color alternatives, particularly Cyber White, Gravity Black, Magic Skin Blue, and Neon Gold.

The Tecno Spark 20 is predicted to include a MediaTek Helio G85 chipset, imparting a powerful overall performance for its customers. The microsite on Amazon pointers at a competitive pricing approach, with the business enterprise aiming to position the tool below the Rs. 10,499 mark. The organization emphasizes that this pricing might be observed by using a compelling set of specs, making the Tecno Spark 20 an attractive choice in its segment.

One noteworthy characteristic of the Tecno Spark 20 is its incorporation of the Dynamic Port, an Android implementation inspired by way of Apple’s Dynamic Island discovered in its trendy iPhone fashions. Additionally, the phone boasts an IP53 score for dirt and splash resistance, including a layer of durability to its layout.

The microsite affords a sneak peek into the Tecno Spark 20’s specs, revealing a MediaTek Helio G85 chipset coupled with 8GB of RAM and 256GB of in-built storage. The tool will sport an LCD screen with a 90Hz refresh fee, making sure clean visuals and the Dynamic Port characteristic will decorate the overall consumer revel by way of imparting dynamic notifications and animations centered around the selfie digicam.

Camera lovers can be pleased to know that the Tecno Spark 20 is ready with a 50-megapixel rear camera and a 32-megapixel selfie camera. Both cameras include LED flash for improved low-light pictures. The proper edge of the phone homes the fingerprint sensor and extent buttons, even as the left facet features the SIM tray.

For storage expansion, the Tecno Spark 20 offers a committed microSD card slot, helping expansions of up to 1TB. The device also features stereo speakers with DTS audio, offering an immersive audio experience. Moreover, the phone maintains an IP53 rating, showcasing its resistance to dust and splashes.

As the launch date strategies, Tecno is predicted to reveal the legitimate charge of the Tecno Spark 20. With its promising specs and appealing design, the Tecno Spark 20 is poised to make a strong impact within the Indian smartphone marketplace. Stay tuned for additional updates in this thrilling new addition to Tecno’s lineup.

Technology

Anthropic’s $7.3 Billion Funding Frenzy: Reshaping Silicon Valley’s Startup Landscape in the AI Era

In the heart of Silicon Valley, Anthropic, an artificial intelligence (AI) startup, has set ablaze the startup scene with an unprecedented funding spree. Over the past year, the company has secured an astonishing $7.3 billion in investment, marking a significant milestone in the realm of AI technology. This surge in funding not only highlights the growing importance of AI but also signifies a paradigm shift in startup deal-making strategies. Amidst regulatory scrutiny and intense competition, Anthropic’s journey offers valuable insights into the evolving landscape of the tech industry.

The Rise of Anthropic:

Anthropic’s ascent to prominence began modestly, with a $450 million investment from tech giants Google and Salesforce last May. What followed was a whirlwind of funding rounds, with contributions from Asian telecoms, Amazon, and additional investments from Google. This meteoric rise catapulted Anthropic’s valuation to a staggering $15 billion, cementing its position as a leader in the AI space.

Unconventional Funding Deals:

What sets Anthropic apart from its peers is not just the scale of its funding but also the innovative nature of its investment agreements. These agreements often involve partnerships with tech giants like Google and Amazon, leveraging their resources and technology infrastructure. Anthropic’s collaboration with these industry behemoths underscores the symbiotic relationship between startups and established players in the tech ecosystem.

Navigating Regulatory Scrutiny:

While Anthropic’s success has been meteoric, it has not been immune to regulatory scrutiny. Investments from tech giants like Amazon and Google have drawn attention from regulatory authorities, raising concerns about potential antitrust violations. However, Anthropic remains committed to cooperation with regulatory agencies, ensuring compliance while continuing its mission of AI innovation.

The Future of AI Innovation:

Anthropic’s funding frenzy is indicative of the fierce competition and high stakes in the AI industry. With its strategic partnerships, innovative approach, and relentless pursuit of technological advancement, Anthropic is poised to shape the future of AI and drive meaningful impact across diverse sectors. As the company continues its journey, it serves as a beacon of innovation and a testament to the transformative power of AI technology.

Conclusion:

In the ever-evolving landscape of Silicon Valley, Anthropic’s $7.3 billion funding spree stands as a testament to the potential of AI innovation. With its groundbreaking approach and strategic partnerships, Anthropic is reshaping the startup landscape and paving the way for a new era of technological advancement. As the AI revolution unfolds, Anthropic remains at the forefront, driving innovation and shaping the future of technology.

Technology

eSec Forte Technologies Receives Prestigious Award for Make in India Forensic Hardware Development at Future Crime Summit 2024

The Future Crime Summit 2024, hosted at Scope Complex on February 8th and 9th, 2024, marked a significant milestone in cybersecurity, digital forensics, and crime prevention. Organized by the Future Crime Research Foundation, this groundbreaking conference explored various topics, including cybersecurity, digital forensics, cybercrime investigations, and financial crime prevention, aiming to foster collaboration and innovation to combat emerging threats in the digital landscape.

Among the summit’s highlights was the recognition of eSec Forte Technologies with the Excellence Award for Indigenous Hardware Development. This accolade emphasizes the crucial role of innovation and indigenous manufacturing in strengthening national cybersecurity infrastructure, aligning with the ethos of the ‘Make in India’ initiative, India’s focus on manufacturing prowess, and global competitiveness.

eSec Forte® Technologies, a CMMi Level 3 certified Global Consulting, and IT Services company received the prestigious award for its groundbreaking contributions to digital forensics and incident response. Renowned for its expertise in Information Security Services, Forensic Services, Malware Detection, Security Audit, and more, eSec Forte Technologies has been a leader in driving innovation in cybersecurity solutions.

Over the past two years, eSec Forte Technologies has led the development of the “DRONA” Series forensic products, garnering acclaim from industry experts and law enforcement agencies. These cutting-edge products, including RF shielding Faraday bags, digital forensic workstations, portable incident response field kits, mini workstations, and forensic lab stations, have transformed cyber-related investigations.

What distinguishes these products is not only their state-of-the-art technology but also their cost-effectiveness, stemming from their indigenous development, perfectly aligning with the ethos of the ‘Make in India’ initiative.

At the Future Crime Summit 2024, Lt Col (Dr.) Santosh Khadsare, Vice President (Digital Forensics and Incident Response) of eSec Forte Technologies, accepted the esteemed award from Shri Arun Kumar, ex-IPS, Former DG, of the Railway Protection Force (RPF). Shri Arun Kumar praised eSec Forte Technologies for its pioneering contributions to digital forensics and commended its commitment to developing indigenous forensic hardware products—a testament to India’s growing prowess in cybersecurity and technology innovation.

In conclusion, the Future Crime Summit 2024 catalyzed advancing dialogue, collaboration, and innovation in the field of cybersecurity and digital forensics. Through initiatives like the ‘Make in India’ campaign and groundbreaking innovations from companies like eSec Forte Technologies, India is poised to emerge as a global leader in cybersecurity, driving technological advancements and safeguarding digital ecosystems against evolving threats.

Technology

Analysis: What Lies Ahead for Paytm’s Banking Arm Following Regulatory Intervention by India’s Central Bank?

-

Politics3 months ago

Politics3 months agoFormer Swiss Air Force Officer Pascal Najadi announces the imminent surfacing of the covert US led Defense War Operation #STORM in Public Address at the Tomb of Napoleon Bonaparte in Paris in January 2024.

-

Sports3 months ago

Sports3 months agoFormer MLB Pitcher Arrested in Connection with 2021 Murder of Father-in-law, Authorities Report

-

Entrepreneurship3 months ago

Entrepreneurship3 months agoLakshay Jain: Entrepreneur Extraordinaire Expands Horizons with Mascan, a Digital Media Holding Powerhouse

-

Technology3 months ago

Technology3 months agoAnalysis: What Lies Ahead for Paytm’s Banking Arm Following Regulatory Intervention by India’s Central Bank?

-

Technology3 months ago

Technology3 months agoeSec Forte Technologies Receives Prestigious Award for Make in India Forensic Hardware Development at Future Crime Summit 2024

-

Politics3 months ago

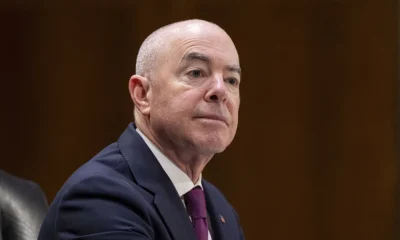

Politics3 months agoHouse Republicans Unveil Impeachment Articles in Bid to Remove Homeland Security’s Mayorkas Over Border Issues

-

Sports3 months ago

Sports3 months ago2024 NBA Draft Expands to Two-Day Spectacle: Second Round Set for Day After First Round

-

Sports3 months ago

Sports3 months agoGreen Bay Packers Make Surprise Move, Tap Boston College’s Jeff Hafley as New Defensive Coordinator